Let me share with you a story that reflect reality of the US manufacturing sector circa…well you guess, the era.

Let me share with you a story that reflect reality of the US manufacturing sector circa…well you guess, the era.

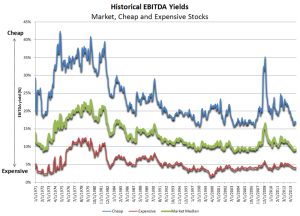

The latest EBITDA <2%, obvious signs of intense competition reducing this business value, as increasingly their buyers viewed their products as commodities and looked to squeeze prices. Many of the familiar management responses broke out into distinct buyer segments.

- Residential market was hit the hardest as 80% of the demand was for a handful of products that the Asian markets overseas had instantly copied an then niched out a more cost effective production environment.

- OEMS , likewise were more cost conscious and still used pressure tactics such as purchase goods they needed at public auction.

- Finally the wholesalers, who demanded quality and quick response time.

When viewed this way it proved difficulty for the executive team to maneuver. Their cushion of years past was significantly disproportionate to the risks they viewed would be necessary to take advantage of new market opportunities. Their zealousness attention to EBITDA made them keenly aware that needed more margin or room to improve in order to expand. But that’s how they may have missed some easier more continuous improvements opportunities due to:

- Inefficiencies in an existing process, existing industry system

- Ineffectiveness noticeable with changes in external or internal expectations

It’s why tinkering versus muddling remains a more prudent attitude and provides any organization ongoing strategic advantage.

This is why paying attention to EBITDA may help, but also may obscure the focal point where improvement or advantages remain possible. Sounds easy to align effort with delivery systems. In earlier eras, your know-how, experience and relationships also insulated you by creating formidable barriers for new entrants into your business. Today, widespread digital connectivity levels the field of play and forces firms to behave more transparently and may make them more vulnerable than ever before.

This is where the best defense proves its offensive value.

- Is the business focused on outputs or on insuring business continuity?

- Do the efforts of individuals align with the tools and systems that further enable their know-how and extend their experience?

If you think I’m talking about employees, then think about aligning tools and system for your customers? Your suppliers?

Consider mapping your Value stream. These diagram materials and the information flow that inevitably occur with every task assignment associated with any product or service creation and its delivery. Focusing your executive team focus and coordinating their activity around the value they are collectively creating and then mapping what’s needed changes their interactions and sets an example. These efforts require leadership to challenge and then reward “What if?” thinking and tinkering. Nip the muddling in the bud. Internally, connect more people to processes and discover how much more effective they become. By rooting out inefficiencies sooner and relaying information through improved channels, the organization and executive team gives permission to the right people in the right place at the right time to see and act on stuff that’s important.

Are you committed to protocol or driving value at every level in the organization?

Enabling more people throughout your business to understand what your business needs to accomplish to be successful unleashes their creativity and also insures cooperation if not a little bit of excitement. These changes require new thinking to structure incentives that incorporate organizational performance and at the same time suspend judgments about what work looks like. It also goes a long way to capturing more value and cement your experienced advantage.